विश्वास नारायण नांगरे-पाटील हे भारतीय पोलीस सेवेतील अधिकारी आहेत. (Vishwas Nangare Patil Poem In Marathi) ते मुंबई शहरात सहपोलीस आयुक्त (कायदा व सुव्यवस्था) म्हणून कार्यरत आहेत. पूर्वी ते नाशिक शहराचे पोलिस आयुक्त होते. पाटील यांनी १९९७ मध्ये प्रशिक्षण पूर्ण केले. 2015 मध्ये त्यांना 2008 च्या मुंबई हल्ल्यादरम्यान दहशतवादविरोधी कारवायांमध्ये त्यांच्या भूमिकेबद्दल राष्ट्रपती पोलिस पदक (शौर्य) देण्यात आले.

विश्वास नारायण नांगरे पाटील मराठी कविता | Vishwa Nangare Patil Poem In Marathi

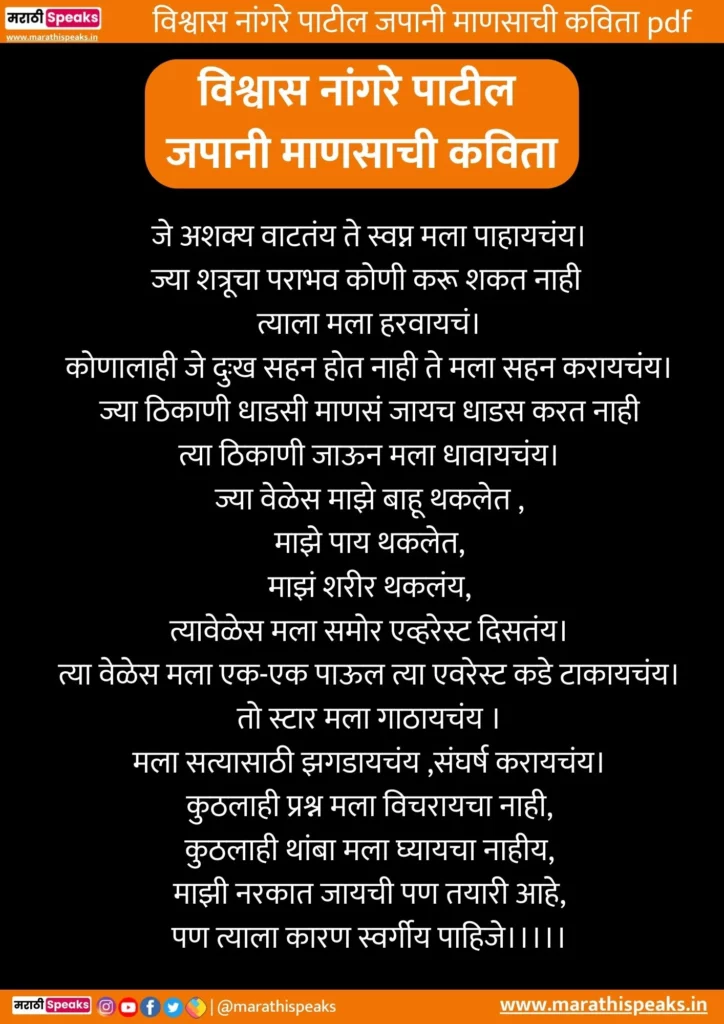

जपानी माणसांची कविता | Japanese Poem of Vishwas Lyrics In Marathi

जे अशक्य वाटतंय ते

स्वप्न मला पाहायचंय।

ज्या शत्रूचा पराभव कोणी करू शकत नाही

त्याला मला हरवायचं।

कोणालाही जे दुःख सहन होत नाही ते मला सहन करायचंय।

ज्या ठिकाणी धाडसी माणसं जायच धाडस करत नाही

त्या ठिकाणी जाऊन मला धावायचंय।

ज्या वेळेस माझे बाहू थकलेत,

माझे पाय थकलेत,माझं शरीर थकलंय,

त्यावेळेस मला समोर एव्हरेस्ट दिसतंय।

त्या वेळेस मला एक-एक पाऊल त्या एवरेस्ट कडे टाकायचंय।

तो स्टार मला गाठायचंय ।

मला सत्यासाठी झगडायचंय ,संघर्ष करायचंय।

कुठलाही प्रश्न मला विचारायचा नाही,

कुठलाही थांबा मला घ्यायचा नाहीय,

माझी नरकात जायची पण तयारी आहे,

पण त्याला कारण स्वर्गीय पाहिजे।।।।।

– विश्वास नांगरे पाटील

विश्वास नांगरे पाटील कविता lyrics | Poem By Vishwas Nangare Patil on japanese

Vishwas Nangare Patil Kavita video In Marathi | japanese poem by vishwas nangare patil

आम्हाला आशा आहे की विश्वास नांगरे पाटील यांची कविता मराठी, विश्वास नांगरे पाटील कविता लेरीकस इन मराठी, Vishwas Nangare Patil Poem In Marathi, Vishwas Nanagare Patil Poem Lyrics In Marathi, Vishwas Nangare Patil Poem Video In Marathi ही पोस्ट नक्की आवडली असेल अशाच प्रकारच्या पोस्ट चे अपडेट मिळवण्यासाठी आपले Telegram चॅनेल ला जॉइन व्हा